SMS Texting Generates 17x More Revenue than Email and 12x than Twitter

Media organizations are thinking non-stop right now about revenue as ad dollars dry up and the competition for reader revenue is as fierce as ever. If you’re part of a media company, you’re likely leaning into a marketing toolkit that includes social media channels, email lists, and banner ads or pop-ups. They’re familiar, however, they’re only reaching a small segment of your potential audience.

For far too long, the media has prioritized platforms that only a fraction of our audiences use and that generate little to no revenue. Only 69% of U.S. adults are on Facebook. 22% on Twitter. Email is closer at 90%, but still not as widely used as text, which has about 97% penetration. We also know that on average, we send 4 times more text messages than emails daily from our phones.

Publishers have jumped on collecting emails in the last several years. But with an industry open rate of over 20%, email’s ability to engage readers can’t touch that of text with a 90% plus open rate. Your future audience is texting, so why not meet them where they’re at?

Texting = Revenue. Plain and Simple.

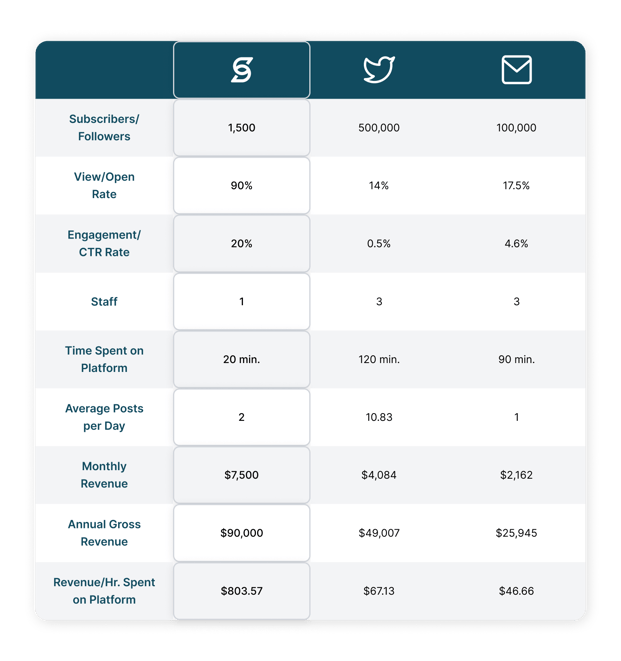

Let’s look at the financial returns of texting your readers compared to reaching them via email or Twitter. These numbers are calculated based on data from our current customers. Below you’ll find brief scenarios laying out the total number of subscribers and followers, and the purpose of each channel. The ultimate result that we’re looking at is revenue generated per hour spent on the platform. This is where Subtext outearns email by 17x and Twitter by 12x.

The Scenarios

Subtext: A media company uses Subtext to provide subscription-based access to an expert journalist on one topic for a monthly subscription fee of $5.

Twitter: A media company with 500K Twitter followers uses the platform to refer traffic back to their site for ad-based monetization.

Email: A media company has a daily newsletter with 100,000 subscribers that share top stories and analyses. It has in-email ads and refers readers back to the media org’s site for ad-based monetization.

The Calculations

For Twitter, we landed on these revenue figures by calculating the view rate and click-through rate based on total followers. We presume any follower who clicks through will see an average of three ads with an on-site CPM of $1.50.

For email, we used the same process for on-site, ad-based monetization at the same $1.50 CPM. We then added revenue from potential in-email ads at a $4 CPM.

The Takeaways

- A smaller audience = more revenue. The biggest takeaway is that with a text audience, a fraction of the size of Twitter followers or an email list, you’re generating 17x the revenue per hour via text compared to email and 12x that of Twitter.

- Less staffing and time = more revenue. Email newsletters take a lot of time to write, and need designers and editors. Tweets need to be frequent in order to find your target audience. Texts are as simple to write and are delivered directly to readers. On average, our hosts spend about 10–15 min. per day, 20 min. max on the platform.

- Higher engagement = more revenue. In a private, direct, and troll-free space, subscribers are far more likely to respond. This in turn produces smart conversations, story ideas, and feedback that converts to reader-centric content and behaviors among your team.

A Final Note

Above we compare Subtext to Twitter and email use. In truth, a Subtext campaign — either paid or free to your readers — becomes part of your user acquisition funnel. Twitter and email are two of the biggest drivers of sign-ups to Subtext campaigns, which is where you can leverage those relationships to earn money.

Where Subtext starts to edge out Twitter and email is in loyalty building. A subscription to Subtext is a statement of loyalty for a few reasons: 1) phone numbers are a valuable piece of data that people don’t hand out frivolously. We all have a garbage email account. And 2) a $3.99 subscription to Subtext is step one in moving subscribers down the funnel to your full subscription product. Or perhaps, a subscriber stays right there at $3.99/mo. But that's not a subscriber you would've had before, opening your publication up to an entirely new audience.

If you're looking for additional ways to generate revenue, schedule a demo with the Subtext team.