7 Proven Steps to Kickstart SMS Marketing for Customer Acquisition

Launching SMS for customer acquisition starts with compliance, then scales through segmentation, automation, and continuous optimization. In practice, high-performing teams follow a clear progression. They define acquisition KPIs (CAC, conversions, list growth), build a compliant double opt-in list, and choose infrastructure that supports two-way messaging and integrations. From there, they segment and personalize messages, write clear single-CTA texts, automate welcome and recovery flows, and test relentlessly.

When done well, SMS delivers immediate, measurable impact—often with open rates cited as high as 98% and strong ROI—making it one of the most efficient channels for customer acquisition when paired with strong consent practices and first-party data discipline.

1. Define Objectives and Key Performance Indicators

Clear goals focus your program on acquisition, not activity. Before sending your first text, set targets for customer acquisition cost (CAC), conversion rate, list growth, click-through rate (CTR), opt-out rate, and customer lifetime value (CLV). Establishing these benchmarks aligns teams and budgets while enabling faster iteration.

For reference, industry reporting on SMS marketing cites open rates of up to 98%, conversion rates of up to 45%, and an ROI as high as $71 per $1 spent—benchmarks that underscore the channel’s potential when it’s compliant, relevant, and well-timed. Use these figures as directional caps, then tailor targets by offer type, vertical, and average order value.

While open rates highlight SMS’s reach, acquisition performance is best evaluated using action-based metrics, such as CTR, conversion rate, churn, and sustained list growth. As outlined in Subtext’s SMS Metrics That Matter breakdown, the most effective teams align metrics to intent—using engagement metrics to diagnose message relevance, growth metrics to assess channel health, and ROI metrics to validate acquisition efficiency across campaigns and flows.

Core SMS Acquisition Metrics

| Metric | What It Measures | Typical Range/Target | Notes |

| Open Rate | Reach/attention | Up to 98% | High visibility; optimize timing and sender identity |

| CTR | Click engagement | 8%-20% | Varies by offer urgency and personalization |

| Conversion Rate | Purchases/sign-ups | Up to 45% | Strong for time-sensitive, incentive-backed offers |

| CAC | Cost per new customer | <20%-30% of first order value | Keep CAC below contriution margin and well below CLV |

| List Growth | Net new subscribers | 3%-10% monthly | Use multi-channel capture; protect quality with double opt-in |

| Opt-out Rate | Churn from messages | <1% per campaign | Spikes signal fatigue or mismatched targeting |

2. Build a Compliant Opt-In Subscriber List

SMS is permission-based. You must obtain explicit, documented consent before sending marketing texts, include required disclosures, and provide simple opt-out paths (for example, “Reply STOP to opt out”). Compliance protects trust, deliverability, and your brand—and it’s non-negotiable under U.S. rules like the TCPA.

To accelerate list growth, integrate opt-in capture wherever intent is high: checkout flows, account creation, lead forms, events, and in-store experiences. Reinforce value with exclusive offers, early access, or VIP alerts, and use double opt-in to validate numbers and reduce spam complaints.

Platforms like Subtext help teams manage this at scale by automatically handling double opt-in, opt-outs, and consent tracking as lists grow.

3. Choose the Right SMS Platform and Number Type

Choosing an SMS platform starts with understanding how SMS fits into your broader acquisition stack. Beyond basic sending, teams should prioritize automation, analytics, compliance support, and how easily your SMS data integrates with your existing systems, like a CRM, ecommerce platform, or CDP. These factors determine whether SMS remains a tactical channel or becomes a scalable acquisition engine.

Number type selection should follow your use case, not the other way around. In SMS marketing, the three most common options are short codes (5–6 digit numbers), toll-free numbers (typically 800-style numbers), and 10DLC numbers (standard 10-digit local phone numbers registered for A2P messaging).

High-volume promotional programs often require different infrastructure than ongoing, conversational acquisition flows. Teams running two-way campaigns or lifecycle messaging typically benefit from A2P-registered setups that support replies, intent signals, and consistent deliverability over time. Cost should be evaluated holistically, factoring in registration, throughput limits, compliance overhead, and operational complexity—not just per-message pricing.

Platforms like Subtext are designed to support long-term, two-way SMS strategies by combining A2P-compliant infrastructure, automation, segmentation, and APIs, while supporting short codes, toll-free numbers, and 10DLC—allowing teams to scale acquisition on a channel they control rather than relying on one-off campaigns.

| Option | Best For | Typical Cost per SMS | Pros | Cons |

| Short Code | Large-scale promos and alerts | ~$0.01–$0.05 | High throughput, brandable | Setup time, higher upfront cost, and approvals required |

| Toll-Free | Support and moderate-volume marketing | ~$0.01–$0.05 | Good deliverability, voice-enabled | Lower throughput than short codes |

| 10DLC | Local presence, two-way campaigns | ~$0.01–$0.05 | A2P verified, scalable, cost-effective | Requires registration and carrier vetting |

4. Segment Your Audience and Personalize Messages

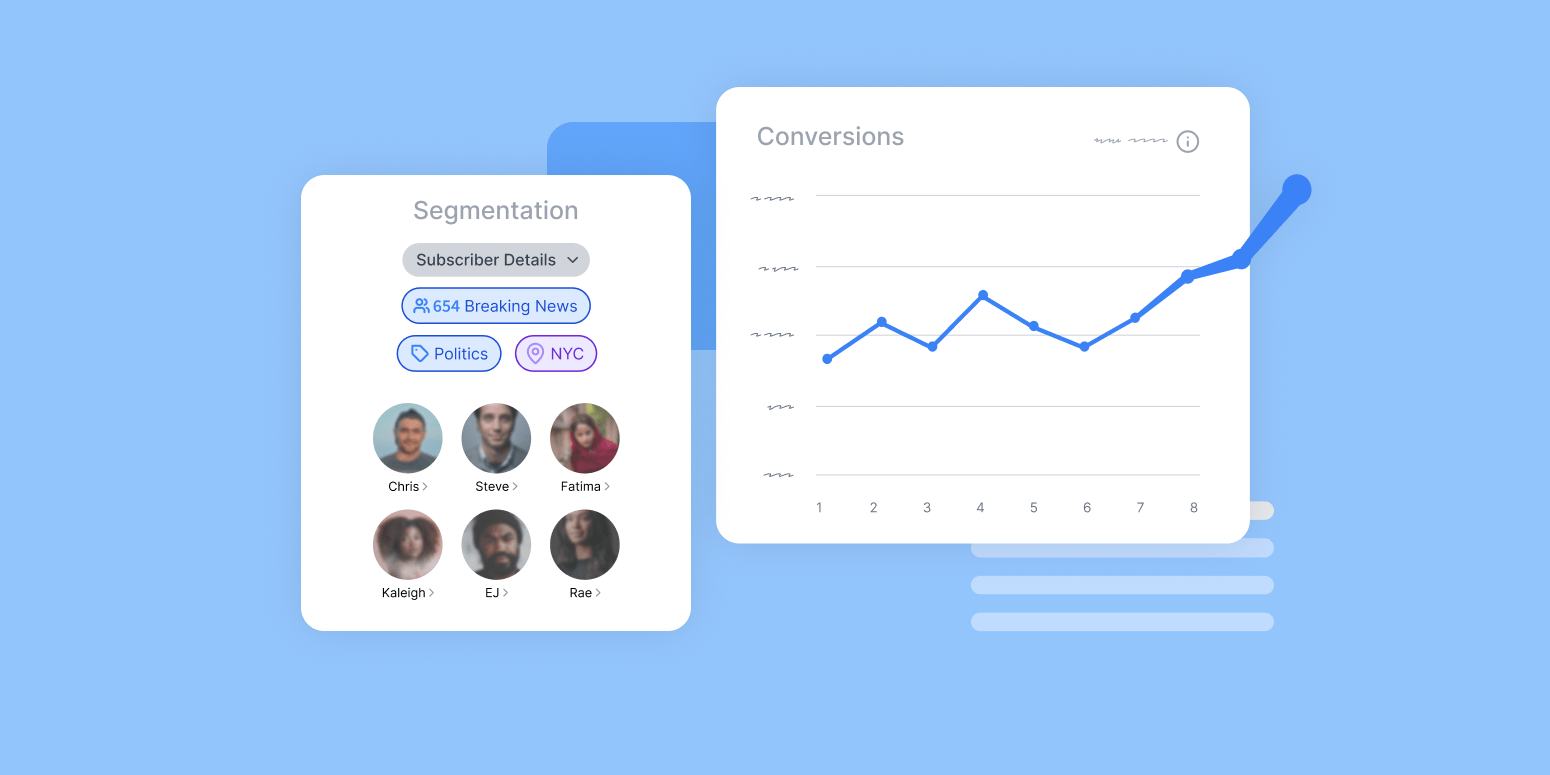

Segmentation is what turns SMS from a high-attention channel into a high-conversion one. Instead of sending the same message to every subscriber, effective programs organize audiences by intent and behavior so each send feels timely and relevant.

At a minimum, teams should separate new subscribers from returning customers. From there, segmentation can evolve based on purchase history, engagement patterns, or lifecycle stage. The goal isn’t complexity for its own sake—it’s reducing unnecessary sends while increasing response.

Platforms like Subtext support segmentation based on subscriber first-party data, making it easier to align offers to intent and avoid oversending audiences who have already converted.

5. Craft Clear, Concise Messages with a Single Call to Action

SMS works because it’s direct—and that same directness leaves little room for ambiguity. Strong acquisition messages communicate one idea clearly: who the message is from, why it matters, and what action to take next.

Trying to stack multiple CTAs or objectives into a single message often reduces performance, even when the offer is strong. Clarity, not cleverness, drives results—especially when the recipient may be engaging with your brand for the first time.

Subtext supports both link-based and reply-based CTAs, giving teams flexibility to choose the interaction model that best matches the moment without adding friction or confusion.

6. Automate Messaging Flows for Welcome, Recovery, and Re-Engagement

Automation allows SMS to scale without sacrificing relevance. Instead of relying solely on scheduled campaigns, high-performing teams use triggers—such as a new opt-in, a specific keyword, an abandoned checkout, or a period of inactivity—to reach subscribers at moments of demonstrated intent.

Well-designed flows don’t need to be complex. A clear welcome sequence, a timely recovery reminder, and a thoughtful re-engagement message often outperform larger, less focused automation trees. The emphasis should be on timing and relevance, not volume.

With platforms like Subtext, automation can adapt based on subscriber behavior or replies, allowing programs to respond dynamically rather than follow rigid, one-size-fits-all sequences.

7. Test, Measure, and Iterate Campaign Performance

SMS acquisition performance improves through structured iteration. Rather than testing everything at once, effective teams focus on a small number of variables—such as timing, CTA language, or incentive framing—and evaluate impact at the campaign or flow level.

Measurement should prioritize metrics that signal real progress toward acquisition goals, including conversion rate, churn, and sustained list growth. Reviewing results by segment helps isolate what’s actually driving performance versus what’s merely correlated.

Subtext’s real-time engagement and delivery data make it easier to identify which messages contribute to incremental acquisition and which should be refined or retired, keeping programs efficient as they scale.

Bringing It All Together: What Effective SMS Marketing Actually Requires

Successful SMS marketing for customer acquisition isn’t driven by any single tactic. It’s the result of disciplined execution across the entire lifecycle: setting the right goals, building a compliant opt-in list, choosing infrastructure that supports scale, sending relevant messages, and continuously measuring what actually drives acquisition.

Teams that see the strongest results treat SMS as a first-party growth channel, not just a promotional add-on. They align metrics to intent, use segmentation to reduce noise, rely on automation to capture high-intent moments, and iterate based on real subscriber behavior rather than surface-level engagement. When these elements work together, SMS becomes one of the most predictable and measurable acquisition channels available.

At its core, effective SMS marketing is about control—control over audience access, data, timing, and message relevance. The framework outlined in this guide is designed to help teams build that control step by step, regardless of industry or audience size.

Take the Next Step With Subtext

If you’re looking to put this framework into practice, Subtext is built to support the kind of SMS marketing outlined above.

Subtext helps organizations run compliant, two-way SMS programs with built-in support for opt-in management, segmentation, automation, analytics, and integrations—so SMS can function as an owned acquisition channel rather than a disconnected tool. Teams use Subtext to move from one-off campaigns to durable, first-party audience relationships that drive measurable growth.

To explore whether Subtext is the right fit for your SMS marketing strategy, you can:

- Book a demo to see how teams use Subtext to launch and scale SMS acquisition programs

- Browse the Subtext FAQ for clear answers on compliance, pricing, integrations, and use cases

Both are designed to help you evaluate SMS marketing infrastructure with the same rigor you’d apply to any core growth channel.